Explore Txeze – Transforming Your Industry with Innovation

Tax Filing Reform for the Driver Community

Discover Txeze – Pioneering Innovation in Technology

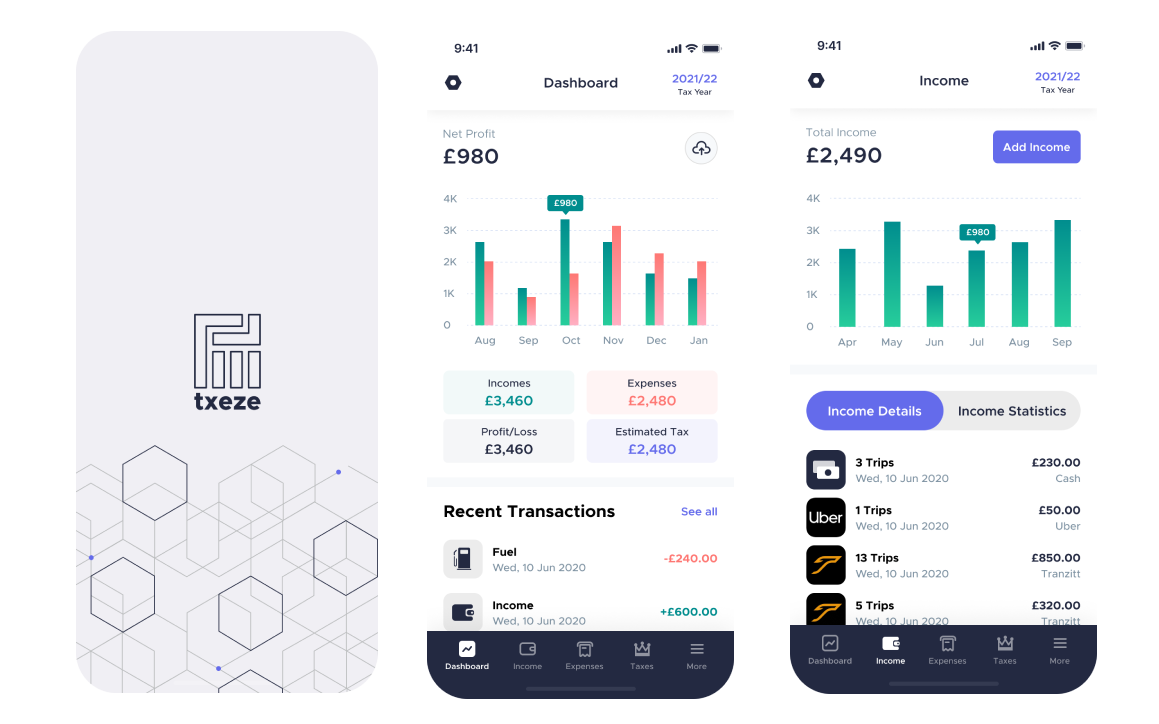

1. Introduction- This case study examines the development and implementation of Txeze, a mobile application designed to expedite and streamline the tax filing process for drivers. The application seeks to provide chauffeurs with a platform that is user-friendly, accurate, and compliant with tax regulations.

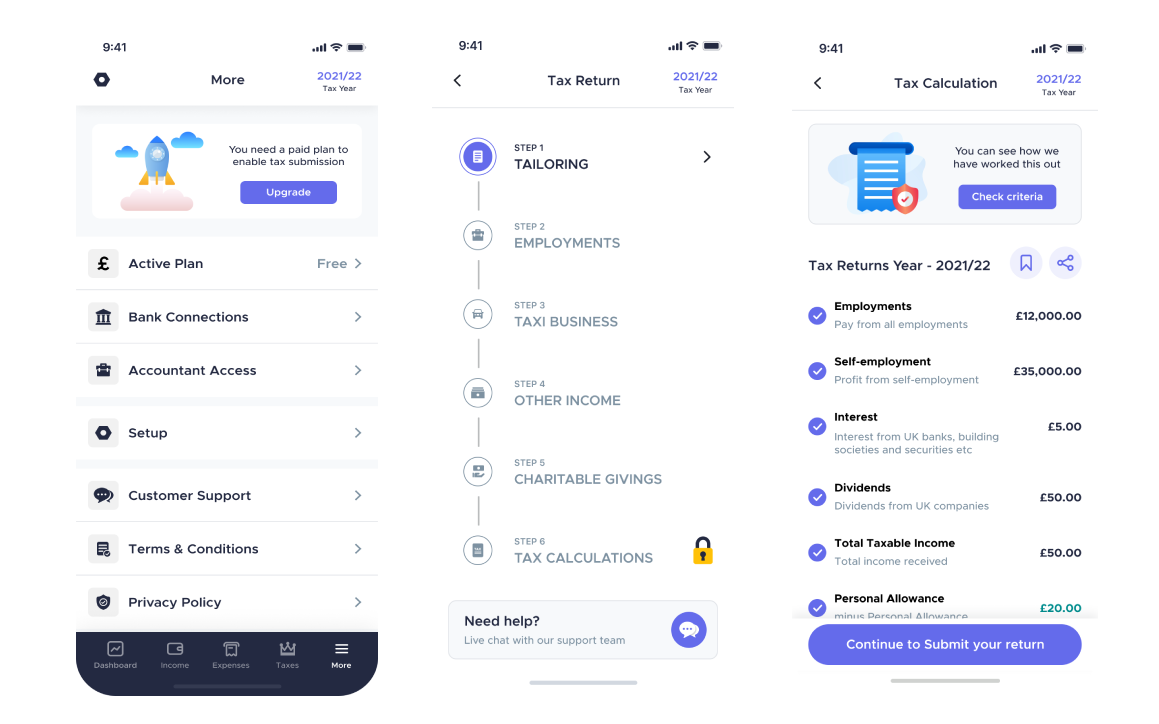

- Facilitate tax filing: Develop a user-friendly mobile application that streamlines the tax filing process for chauffeurs, reducing complexities and reducing the amount of time needed to complete tax-related tasks.

- Ensure conformity: Provide accurate tax calculations to chauffeurs and ensure compliance with applicable tax laws and regulations.

- Collect pertinent data: Permit drivers to readily track and record tax-related data, including mileage, expenses, and income, to facilitate accurate tax reporting.

- Increase deductions: Assist drivers in maximizing their tax returns by ensuring they are aware of deductions and credits for which they are eligible.

- Enhance fiscal management: Provide drivers with tools to better manage their finances and keep track of their income, expenses, and tax obligations throughout the year.

- Friendly User Interface: An easy-to-use smartphone interface that walks drivers through the tax filing procedure step by step.

- Income Monitoring: Tools for tracking and recording money from multiple sources, such as ride-hailing services or delivery platforms, in order to ensure correct reporting.

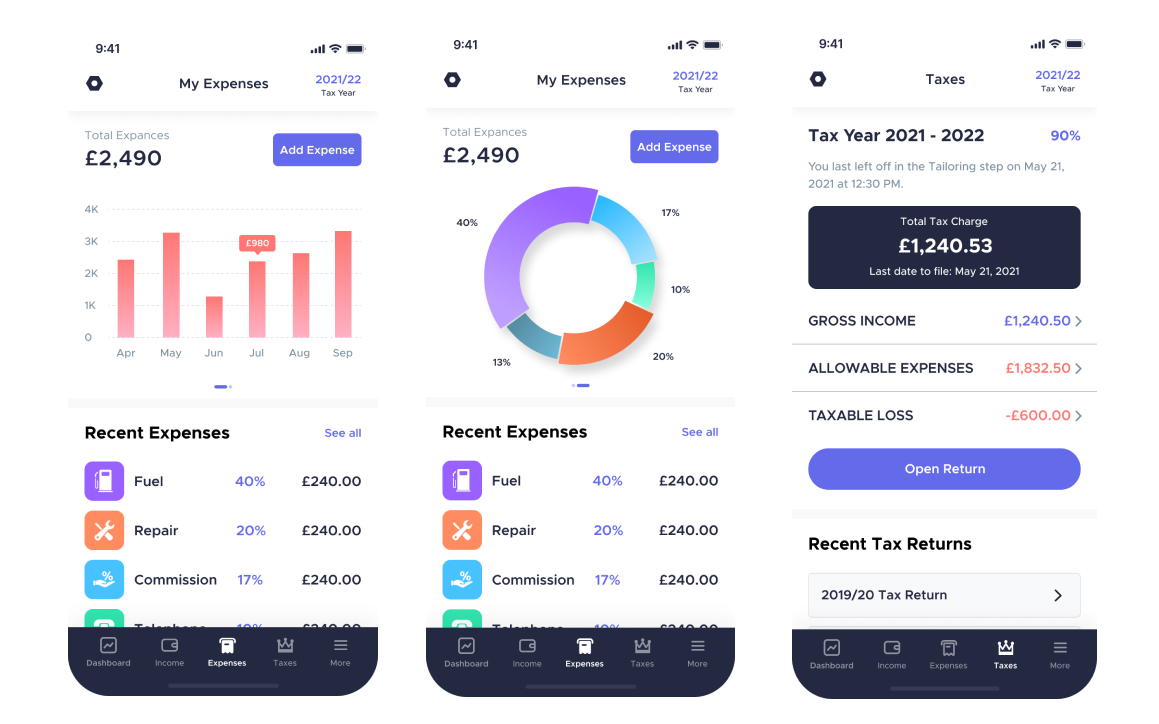

- Management of Expenditures: Tracking and tagging capabilities for business-related costs, such as the cost of gasoline, the cost of car maintenance, the cost of tolls, and the cost of insurance premiums.

- Mileage Monitoring: Integration with GPS technology to monitor and record mileage automatically, thereby simplifying mileage deductions and minimizing manual entry.

- Instantaneous Tax Calculations: The application calculates tax liabilities, deductions, and credits in real time, keeping drivers informed of their financial obligations.

- Administration of Documents: A safe document storage system that allows users to upload and save important tax documents, such as receipts or income statements, in a manner that makes them simple to retrieve when it comes time to file taxes.

- Facilitating Conformity: To help drivers stay in good standing with the IRS, this app details tax laws, changes, and due dates.

- Help for Customers: Drivers who have questions or concerns about their taxes can contact customer service using available methods, such as live chat or email.

- Time-saving and Practicality: The Txeze application reduces the time and effort required to complete tax-related duties for drivers.

- Accuracy and Conformity: The app ensures accurate tax reporting and compliance with tax laws and regulations by automating tax calculations and providing real-time updates.

- Increasing Deductions: The app informs drivers about eligible tax deductions and credits, enabling them to maximize their tax refunds and minimize their tax liabilities.

- Financial Administration: The Txeze provides drivers with the means to monitor their income, expenditures, and tax obligations, allowing for improved financial management and planning.

- Increased Ease of Mind: Drivers can rest easy knowing that their tax filing is handled accurately, reducing tension and the possibility of errors.

- Enhanced Assistance: The availability of customer service channels guarantees that drivers have access to assistance and direction throughout the tax filing process.

- Enhanced Financial Education: The application educates drivers on tax-related issues, promoting financial literacy and empowering drivers to make informed financial decisions.

- Txeze has effectively revolutionized the tax filing process for drivers by providing an intuitive and comprehensive mobile application. The application streamlines the tax filing process, ensures compliance with tax regulations, and maximizes driver deductions. Txeze has enhanced financial management and increased the accuracy of tax filing by incorporating features such as income and expense tracking, real-time tax calculations, and document management. The app's beneficial impact extends beyond tax preparation, empowering drivers with financial literacy and tranquility.

"Let's Connect and bring your ideas to life. Whether you have a question, need a consultation, or want to discuss your project, we are here for you. Reach out to us through our contact form, give us a call, or connect with us on social media. We look forward to hearing from you and exploring how we can work together to achieve your goals."